Modeling Bitcoin Value with Scarcity

Bitcoin is the first scarce digital object the world has ever seen, it is scarce like silver & gold, and can be sent over the internet, radio, satellite etc.

Please forward this to your friends. Let’s help the world get smarter on crypto.

If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here (it’s totally free and always will be):

Headlines

$306 Billion Sovereign Wealth Fund Temasek Buying Bitcoin since 2018 - coingape

Temasek, a Singapore sovereign wealth fund with over $306 billion portfolios has been buying Bitcoin from miners, revealed Global Macro Investor Raoul Pal during a recent podcast appearance. Pal also claimed that governments have been enquiring about buying Bitcoin as well.

US Government Sees ‘Cryptocurrency Spring Fever’ as Great Time to Auction Bitcoin - coindesk

According to an announcement posted Wednesday on the agency’s website, the GSA is offering commission-free bidding on 6.79 BTC, divided into 10 lots. On Thursday, bitcoin was changing hands around $50,800, so the total amount set for auction works out to roughly $345,000. The auction will take place on the GSA Auctions website, starting on March 29 at 5 p.m. ET.

Modeling Bitcoin Value with Scarcity

by PlanB | March 22, 2021 | 9 min read

In this article, PlanB or @100trillionUSD makes the case for Bitcoin having value based on its scarcity and stock-to-flow ratio. He plots Bitcoin’s stock-to-flow against its market value and also adds in silver and gold which are in line with Bitcoin. Here are some key quotes from the article:

Scarcity can be quantified by SF(stock-to-flow).

SF = stock / flow

Stock is the size of the existing stockpiles or reserves. Flow is the yearly production. Instead of SF, people also use supply growth rate (flow/stock). Note that SF = 1 / supply growth rate.

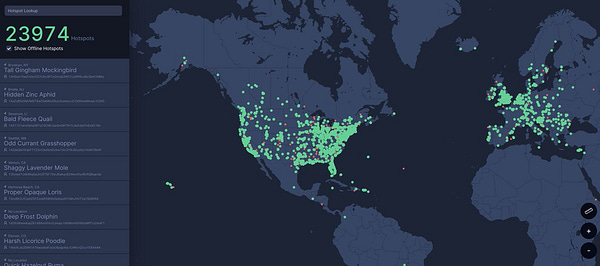

Fitting a linear regression to the data confirms what can be seen with the naked eye: a statistically significant relationship between SF and market value (95% R2, significance of F 2.3E-17, p-Value of slope 2.3E-17). The likelihood that the relationship between SF and market value is caused by chance is close to zero. Of course other factors also impact price, regulation, hacks and other news, that is why R2 is not 100% (and not all dots are on the straight black line). However, the dominant driving factor seems to be scarcity / SF.(See above image)

Adding confidence in the model:

Gold and silver, which are totally different markets, are in line with the bitcoin model values for SF.

There is indication of a power law relationship.

The model predicts a bitcoin market value of $1trn after next halving in May 2020, which translates in a bitcoin price of $55,000.

Read the full post here and some of his other work here.

Best Tweets

Going Viral

If you were curious about the strange clock behind Jack Dorsey as he testified in front of Congress, it’s called a BLOCKCLOCK and you can buy one here for $400 or ~0.0076923 BTC!

Note: This section is for cool/funny clips and memes, so if you come across any, please send our way! We’ll give you the h/t of course!

About Grokking Crypto

Crypto is moving so fast and trying to keep up with everything can feel a bit overwhelming. Dozens of crypto-related articles, podcasts, and YouTube videos are published every day. Moreover, 90% of these resources aren’t even worth reading or listening to, which makes the task of keeping up even more difficult.

Our goal with Grokking Crypto is to handle the screening process for you. We read, watch, and listen to everything crypto so you don’t have to. Each morning, at 8:30am EST, we send out an email with the best resource of the day, for free.

Feel free to shoot us an email with any feedback and suggestions at grokkingcrypto@gmail.com.

Thanks for reading and see you tomorrow!